Experian is one of the largest credit management companies in the world, they are most famous for leading the way in providing rapid results on credit history checks, ensuring that lenders know exactly who they are about to hand a loan over to. While Experian is based in Dublin, they have operational centres in Nottingham, Sao Paulo and in California and they employ a total of 17000 people. Their job is to compile all the data on purchases, income and outgoings on individuals so that when that individual next goes to apply for credit, they can quickly give the lender an assessment on whether they can afford it or not. ExPin is the name of the new system that Experian have developed to further assist third parties in lending.

ExPin’s focus is on the customers of Experian’s clientele. The system compiles data from Experian’s already considerably database and then delivers this information directly to the client. Each ExPin client is given a bespoke service that matches the customers that they might come into contact with, it constantly updates itself so  that the information is always current and relevant to the transaction they are about to make. The quantitative assessment that ExPin will make for clients will take a lot of the hassle out of making a credit assessment themselves, and clients can have confidence in the accuracy of the results that the system provides.

that the information is always current and relevant to the transaction they are about to make. The quantitative assessment that ExPin will make for clients will take a lot of the hassle out of making a credit assessment themselves, and clients can have confidence in the accuracy of the results that the system provides.

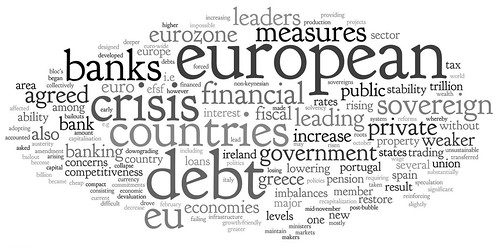

Recently, as part of a multimillion pound deal, Experian have teamed up with Wescot, a debt recovery agency from Glasgow, to allow them to use the ExPin system. This move is set to rapidly speed up the process with which they can recover debts. There are a certain amount of pressures on debt recovery agencies to act within stricter guidelines as per the Financial Conduct Authority (FCA) as well as the limited funds available to most people as a result of the global financial crisis. By utilising the ExPin system, Wescot are now able to rapidly make an assessment on just how much the customers can pay by looking at how much money they spend each month.

The speed at which ExPin can now deliver results to the clients of Experian has helped to ensure the credit management company’s success in the future as well as helping thousands of clients make credit decisions across the world.